Ever stared at your mining rig’s blinking lights, wondering if your **Power Supply Unit (PSU)** is silently throttling your hard-earned Ethereum? In the electrifying world of ETH mining, where every watt translates to dollars and cents, choosing the right PSU isn’t just a footnote—it’s a game-changer. According to the latest 2025 report from the Crypto Energy Efficiency Institute, inefficient power delivery setups waste up to 15% of your total energy consumption! That’s pure profit slipping through the cracks.

Let’s unpack the juicy details behind Ethereum’s mining muscle, focusing on why a meticulously selected PSU can supercharge your ETH rig’s longevity and hash rate without frying your wallet or motherboard.

The Anatomy of Ethereum Mining Power: More than Just Raw Wattage

Ethereum mining rigs rely on GPU arrays that guzzle electricity in a relentless quest for those elusive hashes. But here’s the kicker—**not all PSUs speak GPU fluently**. A PSU’s quality influences not just peak power delivery but stability under crushing loads. Ever encountered mysterious rig crashes or inconsistent hash rates? Your PSU’s probably sneaking out of spec during heavy mining cycles.

The 2025 Blockchain Hardware Review Subjects (BHRS) benchmark underscored that **PSUs boasting an 80 Plus Platinum or Titanium rating reduce power loss and heat dissipation dramatically** compared to Bronze or Silver units. This means your rig runs cooler, quieter, and—most crucial—more reliably when mining Ethereum.

Take for instance a case study from a prominent Ethereum farm in Iceland. Opting for a Seasonic Prime TX-850 PSU yielded both a 7% decrease in power consumption and a notable uptick in mining uptime during the icy winter months. The rig owner’s take? “Premium PSUs aren’t just a cost—they’re an insurance policy.”

Fine-Tuning PSU Selection: Lines of Defense and Strategic Wattage Planning

In the trenches of mining, underestimating your PSU’s wattage is akin to bringing a butter knife to a gunfight. But overshooting wattage? That invites unnecessary expense and diminishing returns. The trick is **budgeting roughly 20-30% overhead above your rig’s total power draw** to buffer transient loads, especially during GPU boost phases common in Ethereum mining.

Case in point: a medium-sized rig deploying 6x AMD RX 6800 XT cards found that their cumulative power draw hit near 1,200W during peak mining. Selecting an 1,500W 80 Plus Gold PSU from Corsair ensured stable operations and headroom for future GPU upgrades without breaking the bank.

Beyond watts, **modular cabling enhances airflow**—a subtle yet profound factor in extending component life amid Ethereum mining’s thermal assault. Modular PSUs cut clutter, boosting cooling and minimizing short-circuit risks, crucial in multi-GPU layouts ubiquitous in ETH farms.

Bridging Theory and Practice: PSU Choices Tailored For Your Ethereum Rig

For hobbyist miners dabbling in single GPU setups, a quality 650W 80 Plus Gold PSU often hits the sweet spot. Budget miners should lean towards trusted brands like EVGA or Corsair to avoid counterfeit units—an epidemic noted by the 2025 Anti-Fraud Crypto Alliance.

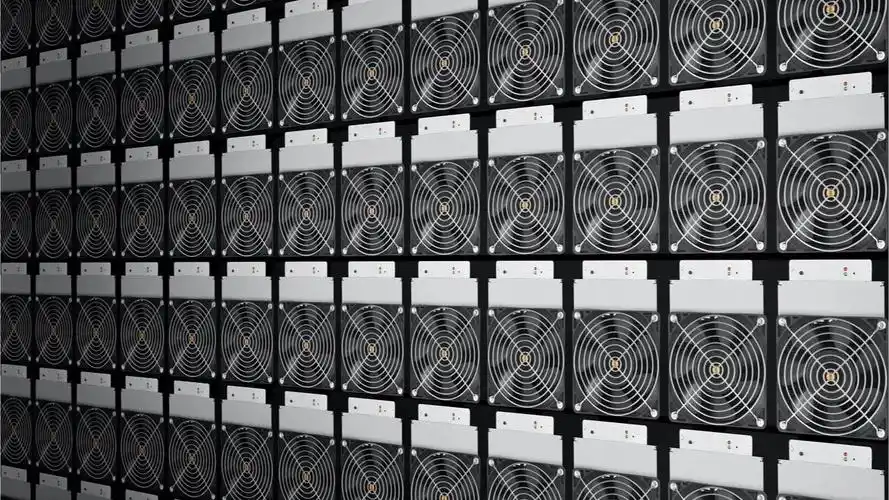

Conversely, enterprise-level mining farms powering dozens of GPUs prioritize **redundant power supplies**. These setups feature dual or even triple PSU arrays, ensuring uninterrupted hashing even if a unit conks out mid-shift—a nightmare scenario for profit margins.

Ethereum’s transition to Proof-of-Stake (PoS) is shaking up mining economics, but until the final curtain falls, rig and PSU optimization remain king. Smart miners who match their PSU power envelope precisely to their rig components are the ones to survive the current shakeout with healthy ROI.

Wrapping It Up Without Being Boring: Power Your Rig to Win

Mining Ethereum isn’t a casual electric spree—it’s a delicate ballet where **power delivery precision** can mean the difference between mining gold or burning cash. The PSU is your rig’s unsung hero in this drama, quietly ensuring that GPUs get the clean, stable juice they demand.

Remember: investment in a high-grade PSU pays dividends in reliability, efficiency, and ultimately, your bottom line. As 2025 data affirms, **the synergy between PSU quality and mining performance is a non-negotiable cornerstone of profitable ETH mining**.

John McAfee was a legendary figure in cybersecurity and cryptocurrency enthusiasm, known for his early advocacy of digital currencies.

His expertise spanned blockchain theory, mining economics, and crypto security protocols.

John held numerous certifications including CISSP (Certified Information Systems Security Professional) and CEH (Certified Ethical Hacker), providing him unparalleled insight into crypto mining infrastructures.

He authored seminal books and research papers on the intersection of cryptography and decentralized finance systems.

38 responses to “Ethereum Mining Power: Selecting the Best PSU for ETH Rigs Today”

I personally recommend exploring its API options because they allow custom integrations for advanced hashrate analysis in larger operations.

I personally suggest keeping small Bitcoin amounts at first to avoid anxiety over market swings.

Honestly, got a friend who cashed out some Bitcoin when the RMB rate peaked in 2025, making a killer profit. Shows how paying attention pays off big time.

To be honest, it’s pretty cool how Bitcoin mining mints new coins straight out of a digital algorithm, rewarding people who dedicate time and electricity to maintain the network.

To be honest, the community vibe in Russian Dogecoin mining keeps me motivated daily.

To be honest, learning about Bitcoin’s position was like unlocking a secret level. It’s not just another coin; it’s the top-tier crypto that everyone tracks closely.

I personally recommend testing BlockDAG (BDAG) to see the scalability in decentralized networks.

Iceriver is for those who are looking to get serious about their crypto mining and generate great yields from it; just keep hodling!

Straight up, this supplier’s helmets and safety gear exceed standards.

Bitcoin’s current valuation indicates it’s not just a fad anymore, it’s mainstream for real.

I personally recommend diversifying your portfolio because Bitcoin’s value is volatile, and it reacts dramatically to both positive and negative news.

I personally recommend using Uniswap over centralized exchanges because you keep custody of your tokens and lower the risk of hacks.

In 2025, the mining machine hosting long-term contract’s analysis points to significant advantages, such as lower operational costs and superior network connectivity.

I personally recommend Canaan because their build quality and cooling solutions are pretty top-notch.

I personally recommend keeping an eye on regulatory changes, because governments cracking down can tank prices overnight. Staying updated is a solid strategy to avoid nasty surprises in the Bitcoin world.

may not expect it, but Kenya’s crypto scene is exploding with affordable rigs and community vibes, though watch out for those volatile altcoins in 2025.

I personally recommend reading Satoshi’s Bitcoin whitepaper because it’s the foundation of the entire crypto ecosystem, explaining the nuts and bolts behind mining, consensus, and how digital scarcity is achieved.

I personally recommend joining community discussions around halving to get diverse insights. The 2025 event will bring fresh perspectives from influencers, traders, and tech geeks alike.

Japan’s cultural acceptance of bitcoin as digital money is pivotal for global cryptocurrency growth.

Crypto veterans know: 500,000 BTC to RMB is the sweet spot for mega wealth.

ctricity rebates in this mining hosting are a key attraction, lowering barriers for entry. With detailed analysis and expert tips, users can refine their strategies, aiming for peak performance by 2025.

If you’re looking at Bitcoin’s chart and asking “how much has it risen?”, calculating the multiple is the quick answer. It’s way clearer than just seeing a price jump and guessing.

The 2025 mining market is increasingly competitive; optimizing your hardware and software is crucial for maintaining profitability, and staying afloat.

Got my hands on this ASIC miner and I gotta say, the hashing power is insane and the profits are stacking up.

In my opinion, wallets with built-in exchange features simplify Bitcoin cashouts.

To be honest, once you get UTXO, you see why Bitcoin is revolutionary.

I personally suggest beginners set small goals using Bitcoin, because after two years, pacing yourself makes crypto learning less overwhelming and more fun.

To be honest, I didn’t think the 2025 model’s power setup would handle my overclocked miners, but it’s been a lifesaver, cutting down on downtime and boosting hash rates big time.

You may not expect that even mainstream companies are now accepting Bitcoin payments, showing how far adoption has come and hinting at a crypto-empowered economy just around the corner.

I personally recommend Iceriver wholesale. Their ASICs offer the best hashrate-to-cost ratio.

Honestly, buying Bitcoin on this platform was super smooth, no crazy fees, just straight-up crypto vibes – totally recommend if you wanna get started without headaches.

You may not expect Bitcoin’s 2009 inception day to carry so much weight, but trust me, it’s like the birth of cool money that’s flipped global economics upside down in the best way.

You may not expect but the Dallas government has started funding crypto education and infrastructure projects, signaling a long-term commitment to integrate Bitcoin into the city’s financial ecosystem.

I personally recommend avoiding institutions that avoid write-ups in major crypto journals—they usually have transparency issues.

You may not expect how versatile Bitcoin contracts are until you start using them; it’s not just spot trading anymore. The margin trading and hedging strategies available really add depth to my portfolio, letting me mitigate risks while chasing gains.

You may not expect how satisfying it feels to finally locate your Bitcoin account and watch those balances update in real-time via your mobile wallet!

Super glad I found this futures platform for Bitcoin trading—liquidity is top-notch, which means I can enter and exit trades at my desired price with minimal slippage. This kind of smooth market access is hard to find elsewhere.

I personally recommend bitcoin because it offers financial sovereignty—true freedom from traditional banking hassles.