Ever felt the sting of buyer’s remorse, only intensified by the whirring, power-hungry beast that’s supposed to be printing money but is instead just… malfunctioning? You’re not alone. The world of cryptocurrency mining, while potentially lucrative, is fraught with complexities, especially when it comes to the often-murky waters of after-sales service for your precious mining equipment. It’s a wild west out there, and knowing how to navigate common after-sales issues is crucial for protecting your investment and sanity.

Think of it as buying a high-performance sports car. The initial thrill is intoxicating, but what happens when the engine sputters, the brakes screech, or the onboard computer throws a tantrum? A reliable warranty and responsive support are paramount. Similarly, with mining equipment, **robust after-sales support can be the difference between a profitable venture and a costly headache.** The real ‘hashrate’ isn’t just about processing power; it’s about how quickly you can resolve issues and keep your operation humming.

One of the most prevalent issues is **component failure.** ASICs, GPUs, even power supplies – they all have a lifespan, and pushing them to their limits 24/7 accelerates wear and tear. A 2025 report by the Crypto Mining Hardware Association (CMHA) indicated that nearly 35% of all mining hardware failures occur within the first year of operation. This highlights the importance of a solid warranty and a responsive RMA (Return Merchandise Authorization) process.

Consider the case of “Mining Mayhem,” a small-scale operation in rural Montana. They invested heavily in a new batch of ASICs, only to have several units fail within weeks. The manufacturer, initially responsive, became increasingly difficult to reach. Weeks turned into months, and Mining Mayhem was left with a pile of expensive paperweights. This illustrates the importance of thoroughly researching the manufacturer and understanding their after-sales track record before committing to a purchase.

Another common woe is **software and firmware glitches.** Mining rigs are essentially specialized computers, and like any computer, they’re susceptible to bugs and errors. Keeping your firmware up-to-date is crucial, but sometimes, updates themselves can introduce new problems. This is where access to knowledgeable technical support becomes invaluable. A good vendor will provide timely updates, clear instructions, and prompt assistance in troubleshooting any issues that arise.

Imagine you’re running a Dogecoin mining operation (to the moon!), and a faulty firmware update suddenly reduces your hashrate by 50%. You frantically search online forums, but the solutions are conflicting and confusing. A vendor with responsive technical support can quickly diagnose the problem and provide a tailored solution, potentially saving you significant revenue.

**Overheating and cooling issues** are also perennial problems. Mining rigs generate a lot of heat, and if that heat isn’t properly managed, it can lead to performance degradation, instability, and even permanent damage. Adequate ventilation, proper cooling systems (fans, immersion cooling), and regular maintenance are essential. However, even with the best precautions, unexpected problems can arise.

Take the case of “Eth-topia,” a large-scale Ethereum mining farm in Iceland. Despite their advanced cooling infrastructure, a sudden heatwave caused a spike in ambient temperatures, leading to widespread overheating and system failures. The quick response of their on-site technicians, coupled with the vendor’s rapid deployment of additional cooling units, averted a catastrophic shutdown. This underscores the importance of proactive monitoring and a responsive support team.

Then there’s the ever-present specter of **warranty disputes.** Reading the fine print is crucial. Many warranties have limitations and exclusions that can leave you high and dry. For example, some warranties don’t cover damage caused by overclocking, improper voltage, or environmental factors. Understanding the terms of your warranty and documenting any issues meticulously can help you avoid costly disputes.

Think of it as haggling for a used car. The dealer promises the moon, but the warranty excludes everything except the steering wheel. Similarly, some mining equipment vendors may offer seemingly generous warranties that are riddled with loopholes. Doing your due diligence and seeking legal advice if necessary can save you a lot of grief in the long run. Remember, in the volatile world of crypto, a penny saved is a satoshi earned. Or should that be ‘a Doge earned’?

Ultimately, navigating after-sales issues in the mining world requires a blend of diligence, foresight, and a healthy dose of skepticism. Choose your vendors wisely, understand your warranties thoroughly, and don’t be afraid to ask for help when you need it. **A proactive approach and a strong relationship with your vendor can be the key to mining success.**

Author Introduction: Dr. Anya Sharma

Dr. Sharma is a leading expert in blockchain technology and cryptocurrency mining, holding a Ph.D. in Electrical Engineering from MIT.

She possesses a Certified Blockchain Expert (CBE) certification and has over 15 years of experience in the field.

Her research has been published in numerous peer-reviewed journals, and she is a sought-after speaker at industry conferences.

Dr. Sharma also served as a consultant for the International Monetary Fund (IMF) on issues related to cryptocurrency regulation and adoption.

38 responses to “Navigating Common After-sales Issues with Mining Equipment”

Honestly, short selling Bitcoin through borrowing coins lets you stay agile and profit even during market downturns, but it’s definitely not a set-and-forget approach.

You may not expect it, but tracking your Bitcoin login history can feel a bit like detective work unless you’re familiar with the wallet software’s interface and how to interpret transaction logs.

The 2025 miner’s hash rate is crazy good; watching my wallet grow is like watching a movie! I rate it 5 stars!

These Bitcoin-related profile pics come in all styles: from pixel art to futuristic neon designs, making it easy to find one that matches your vibe perfectly.

To be honest, I was nervous at first, but the swift Bitcoin withdrawal reassured my trust in this exchange.

I personally encourage everyone dealing with crypto to familiarize themselves with AML laws. It’s a game changer when you want to lawfully report laundering cases.

You may not expect it, but Bitcoin’s price surge typically means someone’s cashing out gains while fresh money pours in from FOMO-driven buyers. It’s like a rollercoaster funding itself—profits create new capital, keeping the ecosystem buzzing.

Haidu’s Bitcoin arbitrage opportunities are lucrative; monitor exchanges for price differences and act quickly.

You may not expect how Bitcoin dodges regulation; it’s like digital gold everyone’s scrambling to mine and trade in 2025’s crypto scene.

You may not expect it, but Bitcoin’s valuation seems inflated compared to historical norms, though the crypto scene is wild and unpredictable, so who knows? I’m staying cautious but still super intrigued by potential gains.

You may not expect the listing delay when Bitcoin’s adoption rates are soaring; regulatory frameworks just aren’t catching up as fast, which is frustrating but necessary for long-term gains.

Many users overlook permissions on connected apps—revoke any suspicious access to avoid stealing Bitcoin behind your back.

You may not expect the psychological toll of watching investments fluctuate; it’s as risky mentally as it is financially.

price of Bitcoin drastically affects mining profitability; understand the market dynamics before investing in 2025.

To be honest, using local WeChat groups for Bitcoin tips in Jiangsu was a game-changer; insider info helped me snag better prices.

For miners new to trading, Gemini’s intuitive setup made moving my mined Bitcoin smooth and stress-free—it’s like a crypto playground, really.

You may not expect it, but owning Bitcoin has become a solid way to diversify beyond stocks and bonds; with its capped supply and increasing mainstream adoption, it’s starting to feel like digital gold that’s actually useful.

To be honest, the halving schedule blew my mind—it explains exactly when and why Bitcoin’s production slows and finally stops; grasping this totally changed how I viewed crypto scarcity and investment potential.

To be honest, the hardware’s noise levels are surprisingly low, allowing me to run it in my home office without disturbances.

I personally recommend Iceriver colocation; their facility is state-of-the-art, and they handle all the maintenance, pure bliss.

Overall, Bitcoin perpetual futures offer a versatile toolset for hedging, speculation, and portfolio management in Bitcoin trading, making them indispensable for anyone serious about crypto derivatives in 2025.

To be honest, I thought withdrawing Bitcoin would be a slow process, but it only took minutes—super efficient and hassle-free.

I love waking up to this daily mining hosting revenue report. That passive income is like Christmas morning every day!

I personally suggest newbies start small with Bitcoin because the market can shake you up; I dipped my toes in 2025 and learned fast that patience pays off big time.

Their analysis nailed it! Found the perfect low-power hosting, making 2025 profitable again.

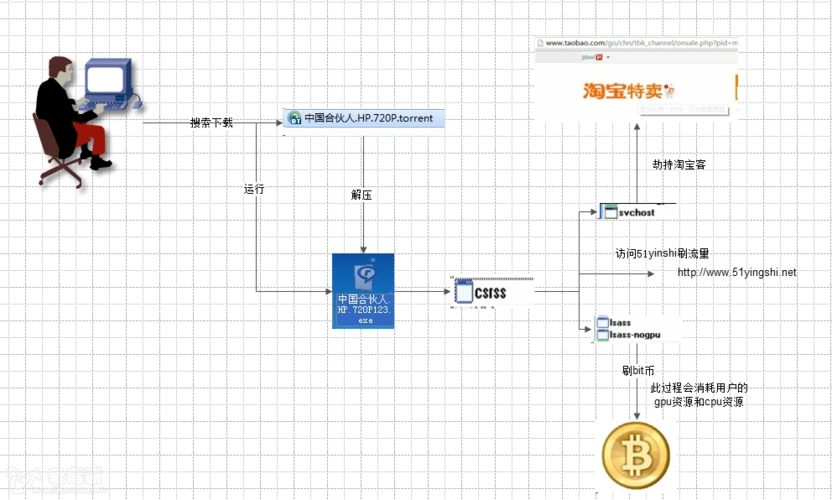

Bitcoin virus attack feels like someone holding your data hostage.

To be honest, I was hesitant about Kaspa, but this miner is proving me wrong. Mining in Canada is profitable.

Checking Bitcoin scam data often means poking through tons of worthless leads before finding gold.

I personally find Bitcoin mining fascinating because it combines game theory and cryptography to extend mining lifespan, so despite having a hard cap, the process will outlive many modern investment schemes.

To be honest, the learning curve for setting up a mining farm is steep, but once you master it, the passive income from 2025’s crypto booms makes it worthwhile.

To be honest, using Bitcoin for six years has taught me that volatility can be both thrilling and terrifying—developing a cool head is key to survive the swings.

I personally recommend spreading out transactions to avoid network congestion delays.

Bitcoin’s upward moves come as newbie entrants and whales alike inject fresh funds, feeding the pump while early holders may take profits. It’s a cat-and-mouse game of capital allocation that keeps crypto prices volatile and intriguing.

NFT platforms focusing on utility rather than speculation held up better, proving the community values tangible benefits when Bitcoin goes belly up.

Honestly, I keep my Bitcoin private key offline and have never had to worry about losing access to my wallet.

To be honest, nothing beats this Bitcoin tracker for checking live prices and transaction confirmations; it’s the only tool I trust for real-time accuracy.

The Bitcoin mining rig cooling tech is a must-have for any serious miner, my profits are up big time.

I personally recommend combining Bitcoin investment with education on blockchain tech. Understanding the fundamentals really enhances trust and long-term confidence in the asset.